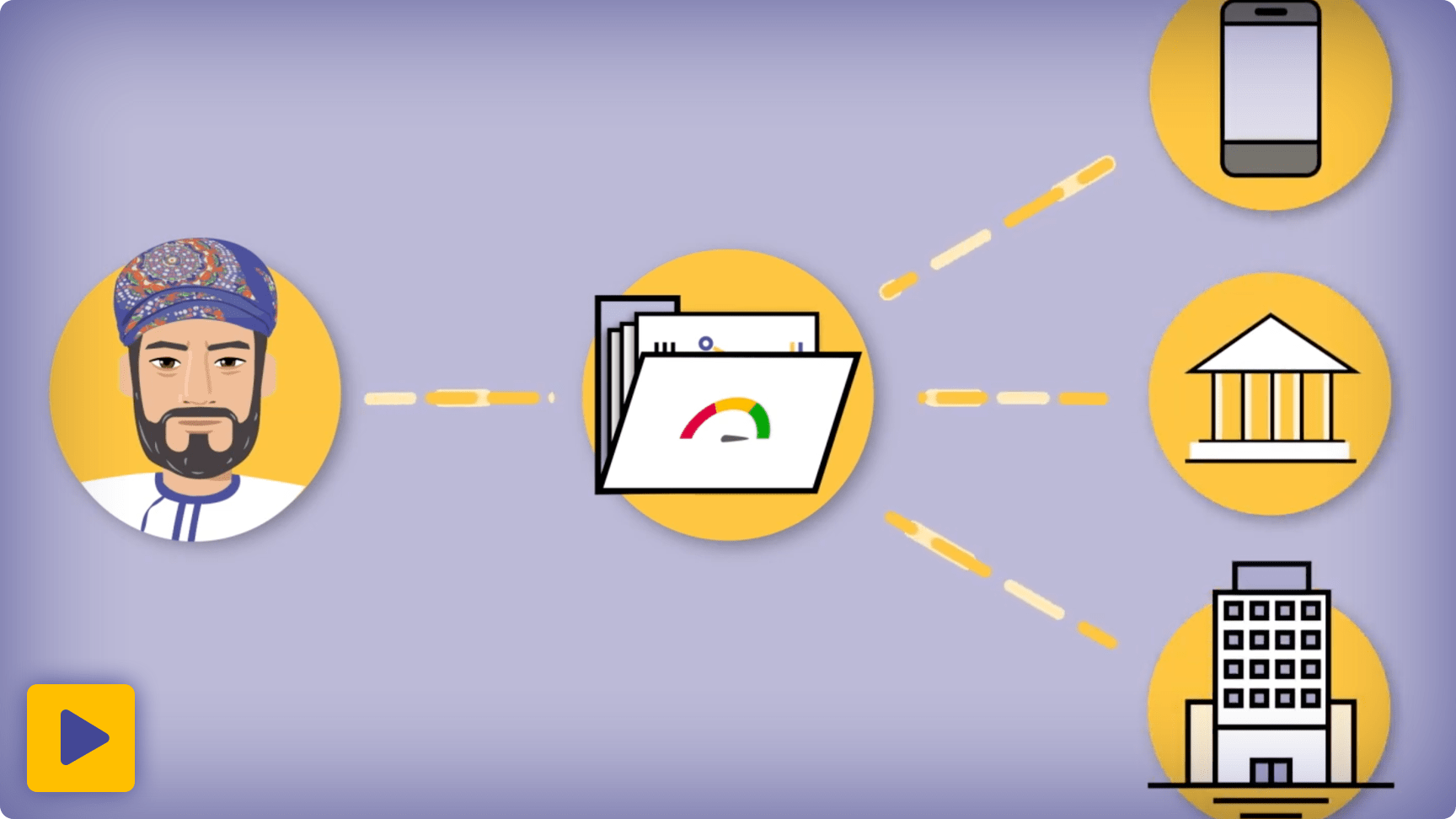

Mala’a Score Report for Individuals

Mala’a Score is a 3-digit number that predicts the likelihood of credit repayments on time. The number ranges from 300 to 900 where the higher the score, the lower the risk of not meeting the financial commitments.

July 27, 2025

July 27, 2025Mala’a Installs its Self-Service Kiosk Machines at Central Bank of Oman Branches in Salalah and Sohar

Oman Credit and Financial Information Center (Mala’a) installs its Self-Service Kiosk Machine at Central Bank of Oman’s Salalah and Sohar branches, in a strategic move to enhance individual’s accessibility to their credit reports and to offer timely and secure digital support through a reliable machine. This initiative forms part of Mala’a’s in expanding its channels […]

Read articleJuly 27, 2025Mala’a Launches Interactive Call Center Service to Enhance Customer Experience

Oman Credit and Financial Information Center (Mala’a) releases its Interactive Call Center service designed to give customers quick and convenient access to Mala’a services. This new service allows Customers to interact using their phone keypad to get assistance with Malaa’ti mobile app, request credit reports, get assistance with Mala’a cautionary list, report inaccurate data on […]

Read articleMay 26, 2025Mala’a Launches Employment Information Service (Huwiya Ratebi) to Enhance Lending Processes and Risk Assessment

In line with Oman’s vision for digital transformation, Mala’a is proud to announce the launch of its new Employment Information Service (Huwiya Ratebi), offering unparalleled value and exclusivity. As a separate addendum to the membership agreement, the innovative service is designed to empower financial institutions with accurate, real-time employment data to accelerate lending processes, reduce […]

Read article